5 TRENDS SPEARHEADING THE FINTECH REVOLUTION

As technology transforms every day, the changes that are taking place plays a major role in the growth and the transformation of the financial service industry. Earlier, the finance industry tended to depend on legacy systems and were extremely reluctant to accept the advent of newer technology. But the story is different in the recent times. Today, the financial service organizations are recognizing Fintech as disruptive and imperative in order to gain success.

According to a PwC’s 2018 Digital Banking Consumer Survey, 25% of customers preferred access to their banks via a digital device. In the ensuing years, the numbers increased by 5%. If a bank or financial institution is not investing in Fintech, it risks losing the competition in the longer run. According to Rajesh Kandaswamy, analyst at Gartner, “Fintech services are complementors, competitors or catalysts to financial services firms. Technology strategic planners who exploit the differences among them will seize growth in financial services in the future.” Several Fintech trends hit the market regularly. Here are 5 trends that are spearheading the Fintech revolution:

1. Role of artificial intelligence:

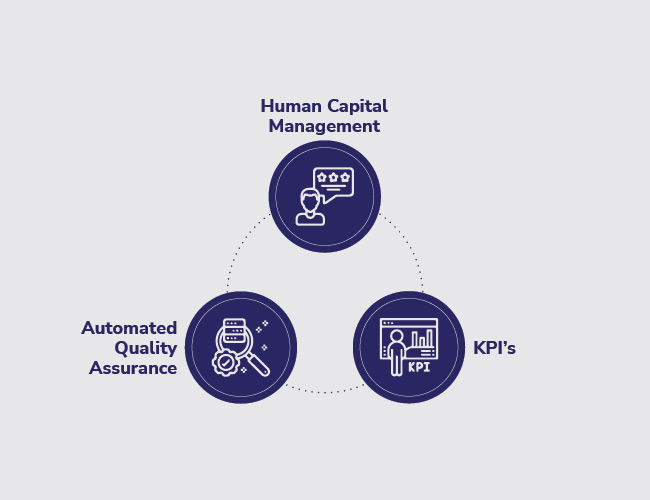

According to Forbes Middle East, digital transformation is present on the agenda for a while, but the emergence of new challenger brands is creating a market pressure which is forcing the banks to adapt to the transformation immediately. Here a very significant role is played by artificial intelligence in process automation. Process automation will help deliver operational excellence across the entire value chain. Although several banks and financial institutions have automated certain back-end processes, end-to-end automation is yet to be achieved.

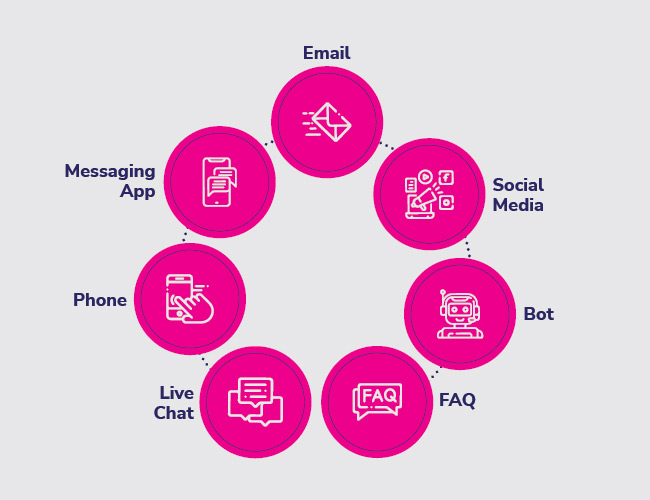

2. Rise of bots:

Bots are creating a massive wave of transformation in the financial service industry. Banks and other financial institutes are deploying chatbots for first level interactions with customers. According to Zor Gorelov, the CEO and co-founder of Kasisto,” This bot enables entirely new experiences to consumers with human-like conversations that are personal and contextual. We’re powering conversational commerce, anytime, anywhere – just as consumers have come to expect.” Bots are also being used to reduce processing time and automate the back-end processes.

3. Blockchain diversification:

Tremendous amount of growth has been witnessed in the number of cryptocurrencies across the globe. Blockchain is now more than just a concept. A recent Gartner survey suggests that “25% of CEOs perceive the impact of blockchain as major or transformational over the coming five years.” It has hugely transformative potential, hence the interest of the financial service industry in blockchain will not waver. According to the head of digital banking of Bank of Ayudhya, Thakron Piyapan,” Technology-based transaction helps enhance their subsidiaries’ financial liquidity toward greater flexibility and efficiency.” The use of blockchain will continue to grow in the future undoubtedly.

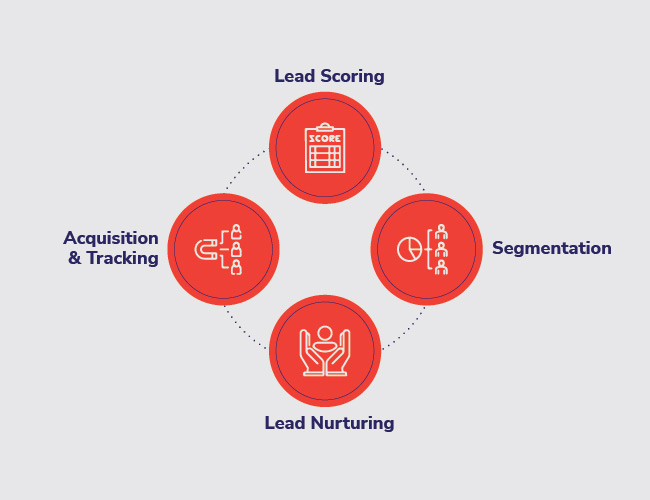

4. Making customer experience the focal point:

Banks are implementing technologies and solutions that will help create a singular view of the customer, address business fragmentation and shatter departmental silos. As customers keep navigating between the different modes of communication with the banks, every touchpoint of the customers will be recorded and consolidated to get a better understanding of them. Getting this singular view will enable the banks to deliver a banking experience that is consistent and that improves customer loyalty.

5. Collaboration between established banks and start-ups:

To cope with the pressure on big banks and the struggles of start-ups, a collaboration between both is the perfect solution in order to be successful. It enables both the parties to stay close to whatever is happening to the market, find opportunities to grow together, and also to open up to the customers to provide the best available products and solutions.

In the coming years, it can be said that the Fintech industry will be closing on major disruption. However, technical superiority will not be the only thing that dominate the future. Business pragmatism, collaboration, transparency and innovation will together bring out the winning combination. 3i Infotech provides you with the infrastructure required to excel in the age of Fintech and help your company transform and be up-to-date.

Harish Shenoy

Harish Shenoy CA Uttam Prakash Agarwal

CA Uttam Prakash Agarwal Mr. Umesh Mehta

Mr. Umesh Mehta Uttam Jhunjhunwala

Uttam Jhunjhunwala

Ranjit Balakrishnan

Ranjit Balakrishnan Emmanuel N

Emmanuel N Ramu Bodathulla

Ramu Bodathulla

Rangapriya Goutham

Rangapriya Goutham Kiran Chittar

Kiran Chittar Sushant Purushan

Sushant Purushan

Nilesh Gupta

Nilesh Gupta Mohan TS

Mohan TS Sanjay Rawa

Sanjay Rawa Dr. Aruna Sharma

Dr. Aruna Sharma Mr.Avtar Singh Monga

Mr.Avtar Singh Monga Mr. Thompson P. Gnanam

Mr. Thompson P. Gnanam Ms. Zohra Chatterji

Ms. Zohra Chatterji Dr. Kalyan Krishnamoorthy

Dr. Kalyan Krishnamoorthy

Mr. Pravir Vohra

Mr. Pravir Vohra Viraf Sirvala

Viraf Sirvala

Amrita Gangotra

Amrita Gangotra